Payroll Tax Calculation App for Odoo | Ensure FBR Compliance in Pakistan

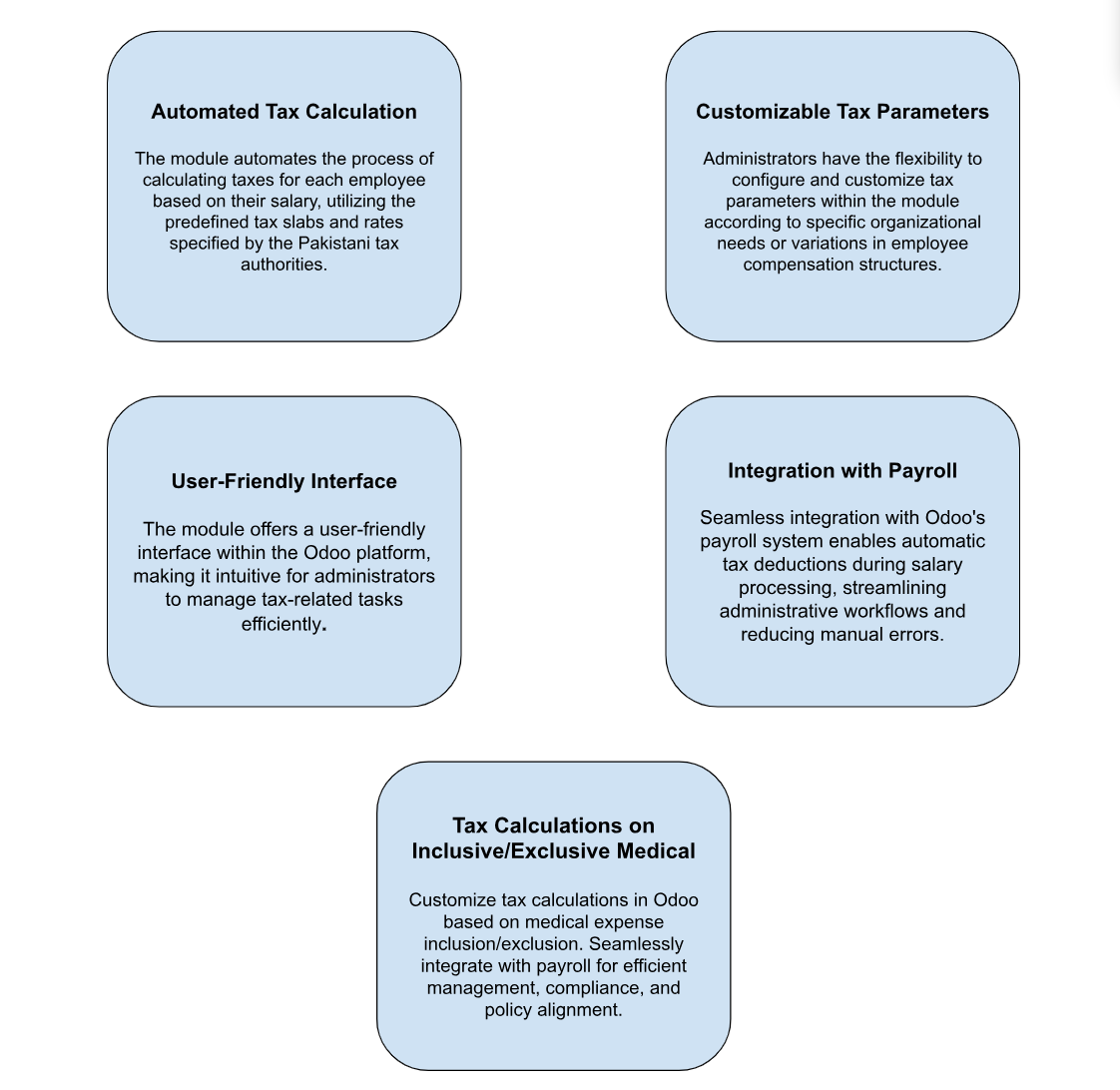

MAIN FEATURES

- Automates tax calculations using predefined Pakistani tax slabs.

- Administrators can configure and customize tax parameters.

- User-friendly interface for managing tax-related tasks.

- Integrates with payroll for automatic tax deductions.

- Customizes tax calculations for medical expense inclusion/exclusion.

- Streamlines payroll management, compliance, and policy alignment.

ODOO EMPLOYEE PAYROLL TAX CALCULATION

The "Pakistan Tax Calculation Module" for Odoo is designed to seamlessly integrate with the Odoo platform, providing efficient and accurate tax calculations for employees in Pakistan. This module utilizes the latest tax slabs and regulations specified by the Pakistani government for the current year, ensuring compliance and precision in tax calculations.

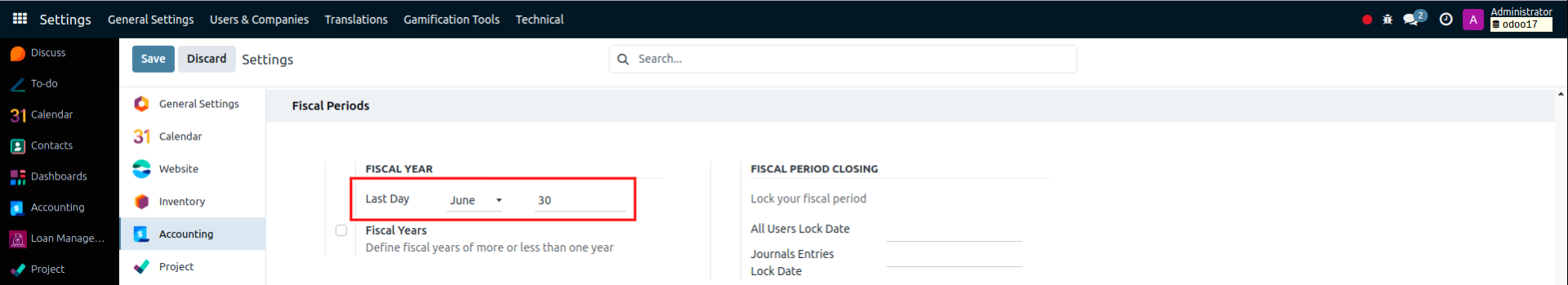

First define the fiscal year in the settings.

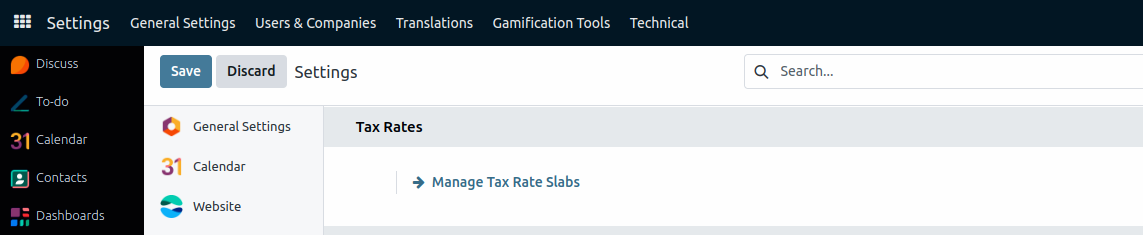

After this add Tax Slabs in the settings.

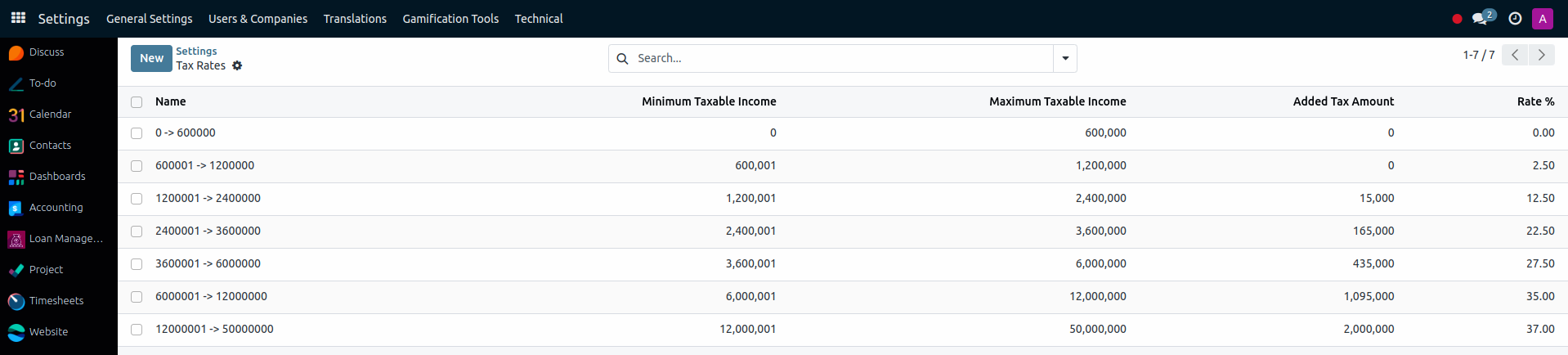

Here define all tax slabs for the current Fiscal Year described by the Government.

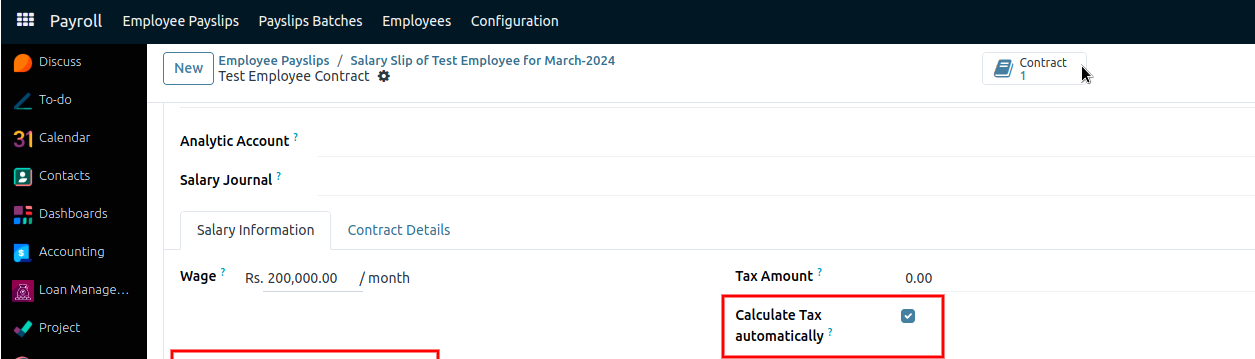

Then there is a check in each employee’s contract whether You want to calculate tax automatically or not.

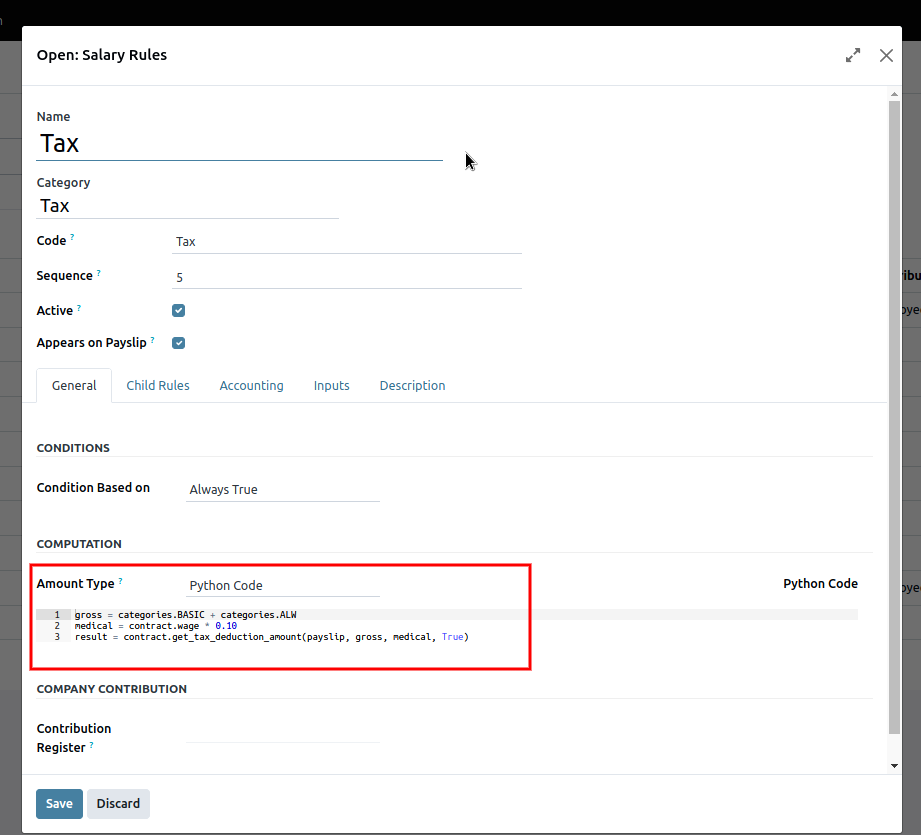

In the Payroll Module create Salary Rules for Tax.

In the Amount Type select Python Code And below code to it

gross = categories.BASIC + categories.ALW

medical = contract.wage * 0.10

result = contract.get_tax_deduction_amount(payslip, gross, medical, True)

Gross is gross amount (Add formula how you calculate Your gross)

Medical is medical amount (Add formula how you calculate Your medical)

Result is a function that returns tax amount, in which payslip is the current payslip, gross(gross amount), medical(medical amount) and this True means tax calculation without medical amount, if it’s False it means tax calculation with medical amount.

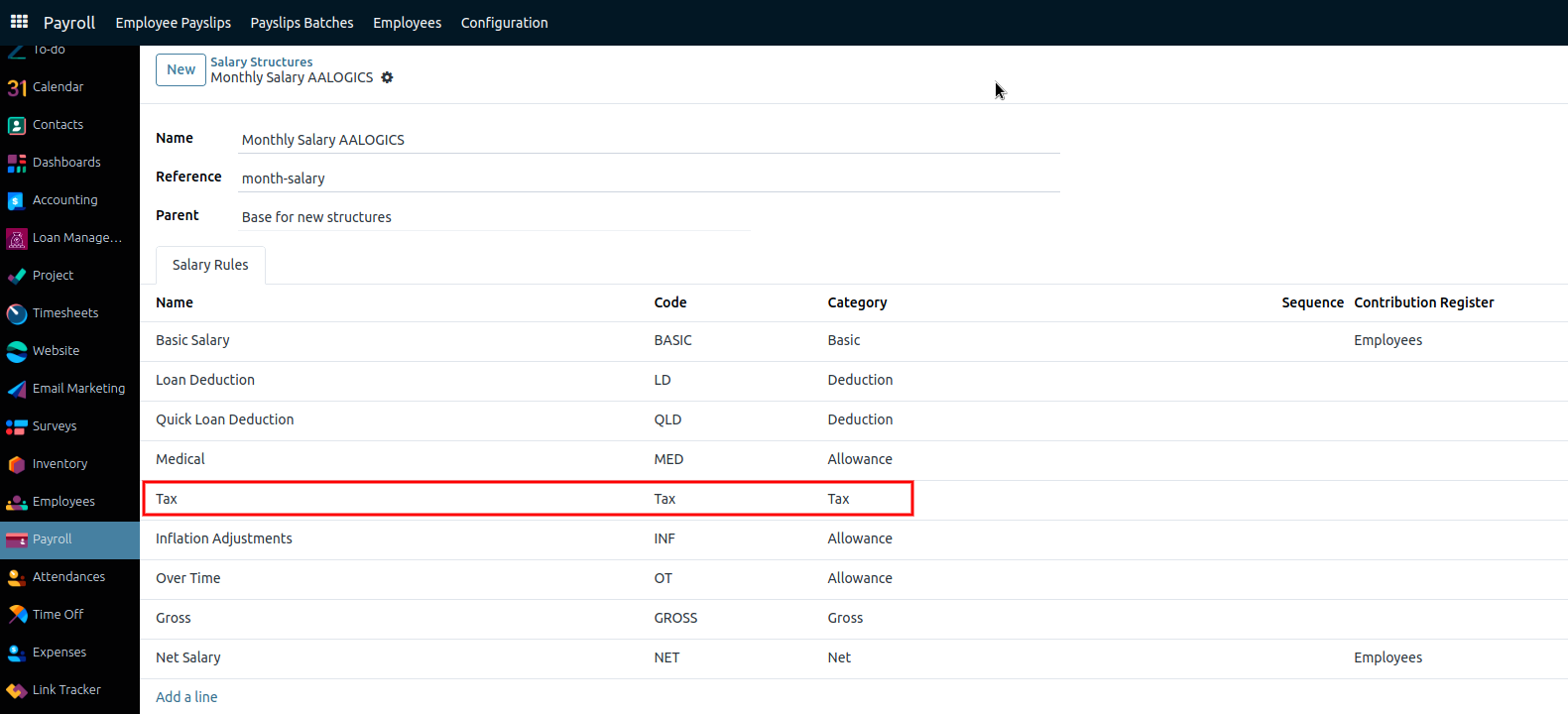

Then Add this rule to the salary structure where you want to calculate the tax for Employees

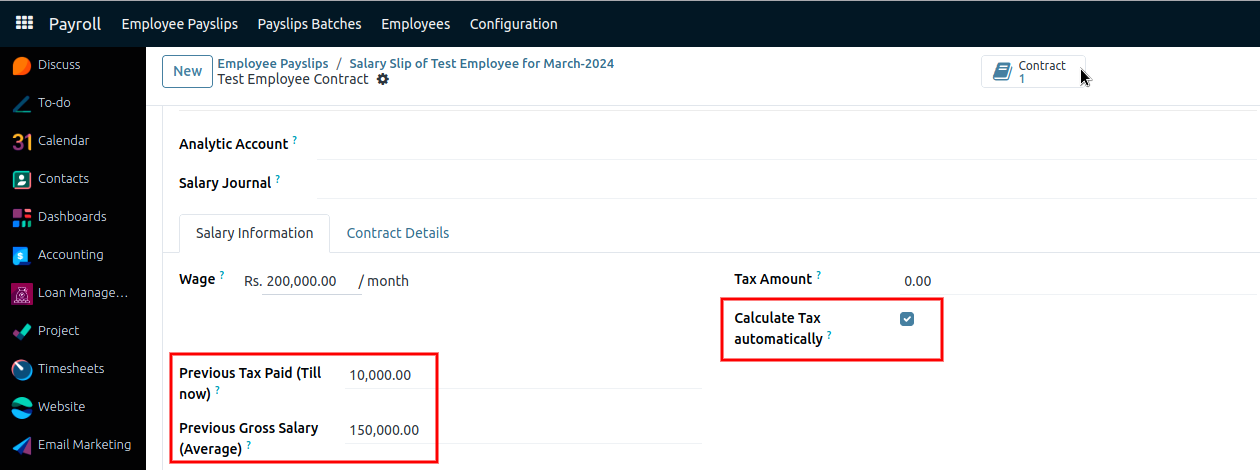

Now if any employee comes in the middle of the Fiscal Year then in his/her contract two fields will be filled, previous months tax paid in the current fiscal year and the average of previous months salaries for the current fiscal year, these fields are mandatory if previously tax paid else it would be empty.

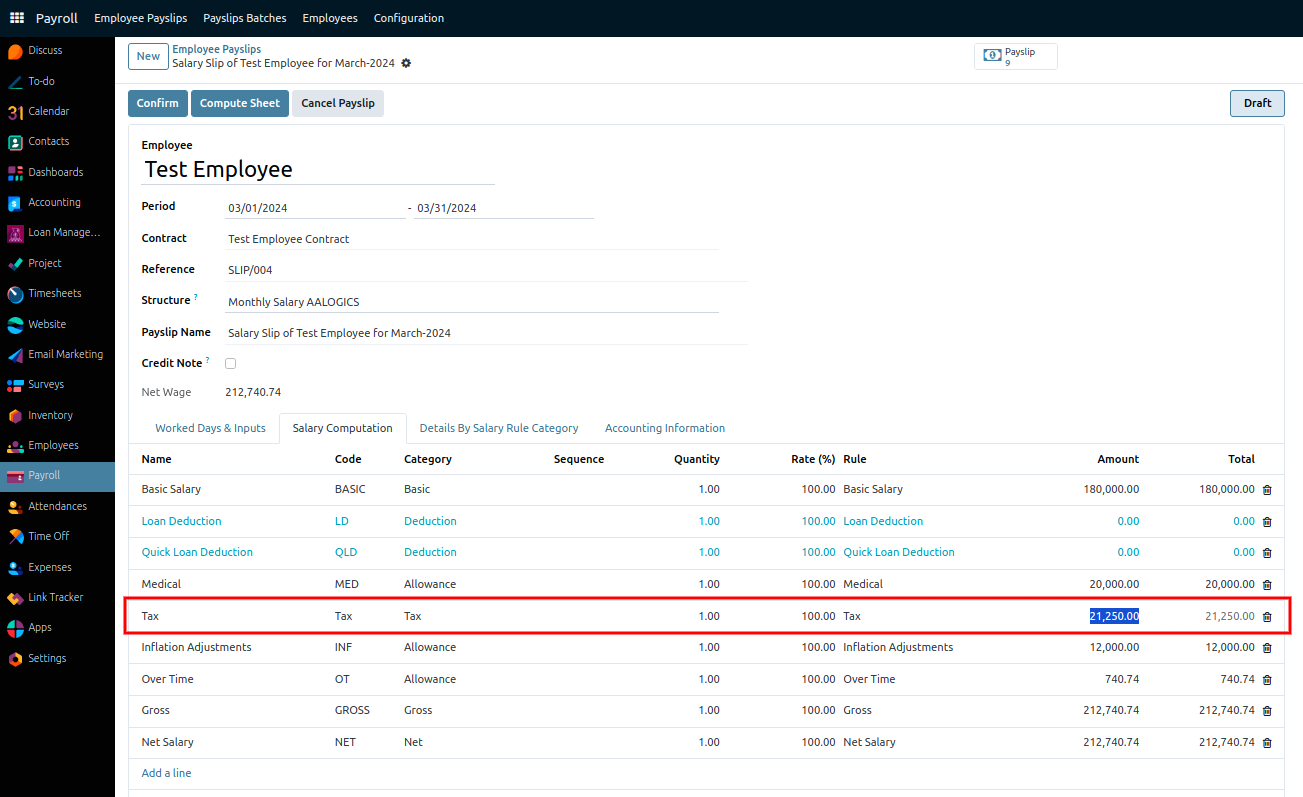

Now when any payslip is computed then the tax will be automatically calculated along with above configurations.

This is how tax will be calculated on payslips for each employee if tax automation is checked in the respective contract of that employee.

Validate your login

Sign In

Create New Account